In this third post, the final instalment of the series, we’ll see why Banking as a Platform (BaaP) strategy makes sense for banks of the future

Curated Marketplace

With BaaP, banks can curate the best applications that complement its customer and product strategies. BaaP will help banks create marketplaces that meet customers’ banking needs through a wide mix of in-house and externally developed products and services, all provided on bank-owned platforms. The solutions can be built either using tools such as banks’ developer portals or created independently.

But can BaaP prevent the banks’ existential crisis due to disintermediation or will it deepen it further?

Disintermediation due to ‘Unbundling’ –Threat or Opportunity for Banks?

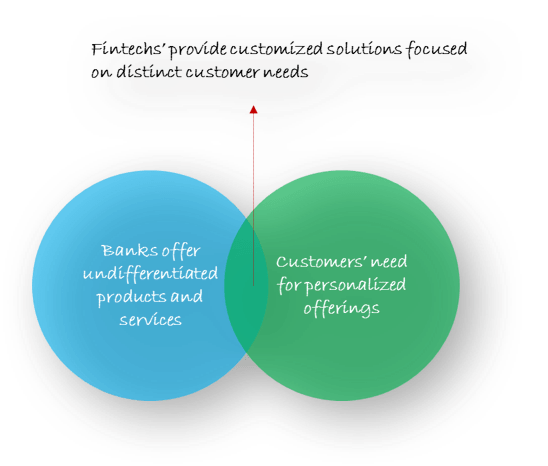

Today, as banks face declining interest income from their existing business models, the tactics adopted by most banks, in a bid to retain customers, lack differentiation. It’s not uncommon to see banks following up with similar products or services as those launched by competition. If a bank launches a new voice-based authentication, mobile wallet or even a mobile app, other banks soon follow suit with similar offerings. Undeniably, it’s great that banks are constantly innovating with new technologies, be it biometrics, virtual assistants, augmented or virtual reality, but in addition to these solutions, customers seek relevant financial products or services, be it deposits, loans or financial advice, customised to individual needs.

So, when nimble fintech companies deliver personalized experience through a deep and focused understanding of the pain points in customers’ banking journey, what does it mean for customers and banks?

For customers, it’s a great deal – access to better products, elegant user interfaces and enhanced services. But the downside is, customers must deal with a fragmented set of service providers for different services – loans from one company, investment advice from another, deposits from a third and so on.

For banks, fintechs with their narrow offerings, minimal regulatory obligations and zero legacy technology infrastructure, are an uncomfortable reality. Unless of course, they acquire a fintech (BBVA’s acquisition of Simple) or partner with one (HSBC with Tradeshift). But many such relationships are largely driven by a zero-sum mentality, where one party wins often at the expense of the other smaller player.

But it doesn’t have to be this way. With BaaP, banks can design a win-win strategy for themselves, their partners and most importantly, for their customers.

But as we’ve seen with successful platform companies, access to internal data, transactional and relationship, are provided through APIs to allow third parties to participate in building ecosystems. As banks plan their platform journey, they must look at the kind of APIs that would help their partners devise new uses for their existing offerings. It could be a new product, service or even bringing banking to customer groups such as the unbanked. Though it’s often difficult at the outset to predict the innovativeness of the use cases devised by external participants and the ways such use cases could translate into tangible benefits for the banks, yet providing APIs is a crucial first step.

Starting small with BaaS

Not just banks, even financial service providers such as Visa and MasterCard are facing disintermediation from the likes of PayPal, Dwolla and Square.

Like BBVA and Capital One, if one were to look at the product roadmaps of Visa and MasterCard, it quickly becomes apparent that a robust platform-as-a-service strategy is necessary to help them pivot from their traditional business models, increasingly under threat from upstarts. In recent years, both have introduced developer platforms, that support external developers, technology companies and financial institutions develop innovative application prototypes. The card processors have turned catalysts for spurring ingenious use cases, leveraging their years of expertise and data.

For instance, Smooth Commerce, a Canada-based mobile commerce and engagement platform, integrated Visa’s Checkout API to streamline customer onboarding, loyalty and payment processes. For Smooth Commerce, the clients are retail businesses who on one hand, use its platform to offer a seamless payment experience to their customers and on the other hand, derive actionable insights from analytics offered by Smooth Commerce’s platform. Now imagine, if Visa had decided not to provide APIs such as Visa Checkout to third parties such as Smooth Commerce. Of Visa’s customer base of merchants or retailers, only a subset would have integrated Visa Checkout on their websites or mobile apps. But companies such as Smooth Commerce that greatly expand the reach of Visa by not just offering retailers Visa’s seamless checkout process but also providing information on their customers, their shopping behaviours and ways to engage them effectively, thus driving more traffic back to Visa.

For banks, providing APIs is a great way to encourage product development. While partners can leverage bank-owned assets such as data and customer relationships, banks can acquire fresh data, through the new offerings, on different customer behaviours and journeys.

Beyond BaaS to BaaP

Consider peer-to-peer payment or e-commerce providers that largely deal with micropayments, transactions that are small in value but high in overall volume. Most of these companies don’t have the technology infrastructure to process the high volume of transactions daily. And because financial transactions must also follow compliance and legal procedures, together the two play a key role in determining the scalability of such companies’ operations.

And precisely these challenges of scalability and regulatory compliance are what makes the idea of BaaP, strongly appealing to those who can’t otherwise afford to set up financial services on their own.

But will BaaP render banks simply as infrastructure facilitators that enable third parties to build applications and control customer interactions?

On the contrary, with BaaP can lead to new monetization opportunities.

New Revenue Models for Banks

White Labelling

solarisBank, a Germany-based fully licensed digital bank, is on a mission. It wants to help companies, any company, become financial services providers. solarisBank, using its regulatory and technology infrastructure, has developed a modular banking kit that includes APIs for account and transaction services, compliance, loans, working capital and more.

And who would be the likely customers of solarisBank?Any company, from fintechs, telcos, e-commerce providers to internet companies that want to offer financial services but lack banking licenses or the technological know-how to do so.

Fidor Bank, another German digital-only bank, follows a similar model of serving customers through its open source platform and easy to implement set of APIs. It has already helped a leading German telco and a UAE-based bank set up digital banks using its platform. IN 2015, six years after it was founded, Fidor attributed 30% of its revenues to its platform based technology offerings.

More recently, BBVA has released eight APIs for commercial use by third parties. The APIs, applicable for a host of use cases from cards, payments, accounts, loans to notifications, can be bought for a fee and integrated by companies, start-ups and developers into their products.

Alliances and Partnerships – All about Relationship Management

Changing customer and competitor dynamics should compel banks to explore new sets of services that don’t necessarily fall within the ambit of conventional offerings.

A 2017 report by Accenture states how banks are well positioned to offer non-bank and add-on services such as home security, roadside support – peripheral yet essential services associated with traditional banking products like mortgages and vehicle loans.

A BaaP strategy is fundamentally about building an ecosystem of partners who could effectively serve a bank’s customers. While BaaS and modular banking platforms are essential for BaaP, establishing and leveraging relationships with service providers could become a strategic and difficult to imitate advantage for banks.

For BaaP to reach its full potential, banks should look at three types of customers/ partners –

- Technology companies/developers/ fintechs

- Service Providers (retailers, property firms, educational institutions and so on – ranging from small businesses to established firms)

- End users

- While the first and third types are well understood, it’s the second set of customer/ partner relationships that banks should start focusing on.

For instance, in the mortgage space, banks can build a network of property firms that it can use to recommend best-fit solutions based on customers’ location, budget and property preferences. With banks providing the validation layer, in terms of verifying and onboarding only credible partners, customers are assured of dealing with trustworthy parties. The property verification service can be either offered by banks directly or through their fintech partners.

Such a B2B2B2C model can be another avenue for generating revenues for the banks.

Winner takes it all

With regulations such as PSD2 and Open Banking compounded by surging demand for better products and services, banks will look to partner with upcoming firms that serve niche customer needs well.

Exclusive agreements could become a favoured integration option for banks curating the ecosystem for superior solutions. Fierce competition to partner with the best of breed fintechs and other service providers could mean only the most aggressive, persistent and astute banks will succeed in onboarding the most competent partners. Such alliances will result in greater value generation for all the ecosystem participants, leading to strong network effects.

Challenges in implementing a platform strategy

Technology changes for the better

Technology infrastructure that allows easy integration of applications and functionality, both internal and external, is crucial for BaaP. But traditional banks have been in existence far longer than the new age companies covered here which means that banks must overcome legacy technology infrastructure challenges not faced by its younger competitors.

Additionally, all leading platform providers have modular architectures that permit easy interoperability. The platforms are also built on open source technologies, such as Linux, Ruby on Rails, Apache, MySQL, PHP and so on. Banks, on the contrary, have legacy banking applications built on proprietary technologies, lending a high degree of non-homogeneity and making interoperability a major challenge. Furthermore, banks typically have multiple core banking systems for the different geographies they operate in. The multivendor nature of these applications means that interoperability is possible only through manually intensive customization. Without a flexible middleware to connect all such disparate applications, banks have resorted to building additional layers, a short-term fix that only serves to increase the complexity – a situation not designed to scale for innovation, faster time to market, customer experience and efficiency.

However, a growing positive trend in the financial services space is the move away from building custom solutions to using open source tools and components. Financial institutions are increasingly embracing the idea of contributing to the open source community as opposed to the earlier practice of building everything by themselves. Doing so has helped the companies improve their systems at a much faster pace by leveraging the power of collective wisdom of the open source community.

This is an important step in building the right infrastructure that would allow easy integrations among the bank and its various ecosystem partners. The other step, a longer-term approach would be to look at overhauling complex core banking systems that prevent banks from attaining ‘single view of customer’, a critical factor for banks to succeed at forging and sustaining profitable customer relationships.

Culture Maketh a Bank

Like digital, can BaaP be regarded as a new channel or distribution medium? Or is it something much more? BaaP, if implemented right, can change the way banking has always been done. It’s a paradigm shift but one that at some point, I believe will be adopted by most large banks. But the success of BaaP relies heavily on the ecosystem partners that a bank would choose to associate with. Technology, though hugely important, could still be replicated. Relationships not so much. With BaaP, banks would have to encourage collaboration and healthy competition among its internal workforce and those of its ecosystem partners. Changes, product or service related, will require coordinating and communicating among multiple sets of stakeholders such as financial technology companies, service providers and independent developers. Mediating and negotiating would be important aspects of managing relationships. For banks used to absolute ownership of their product and service stacks, such a change might be difficult to adapt to. The good news is that banks have started to, in small ways, engage with fintechs and start-ups through accelerators, incubators and hackathons. But rather than limited or one-off interactions afforded by the current practices, BaaP should make the internal-external partnerships, the very foundation of the banking experience.

For banks to succeed with their BaaP strategy, they should be prepared to revamp their culture from top-down. Banks must start stressing the urgency to master collaboration and coordination skills along with transparent communications. The biggest change would be to develop the ability to segue from siloed, functional thinking to enterprise level thinking, characteristic of most innovative companies.

Summing it up

It has increasingly become clear that banks are unlikely to be a one-stop destination for their customer’s banking needs given banks’ legacy technology systems and siloed operating ways. Banks will find it difficult to flexibly meet growing customer expectations. And if we were to look at the customer groups across the wealth pyramid, it’s clear that banks in their current avatar cannot scale to serve the different groups, each with their own complex requirements for banking products and services. BaaP is crucial for banks to stay relevant or else banks’ run the risk of obsolescence due to fragmentation of its offerings by fintechs and non-financial services providers.

Humanizing Banking Interactions

“I think what’s going on is a commoditization of linear intelligence. Robots will almost definitely be better than we are at number crunching and linear processes. But I think humans are really good at being human, we’ve just lost the time and inclination to do that. As we seek to be relevant in a world that’s being taken over by robots, these unfocus techniques will place us at an advantage.”

-Srini Pillay, Associate Professor, Harvard Medical School and Author of Life Unlocked

Source:Medium.com

With BaaP, banks should look at overhauling their infrastructure to enable easy interfacing with external partners. Banks should let their partners take lead in product and service development. At the same time, banks should be in control of all the customer data that flows across the multitude of applications offered by their partners.

Focusing on operational efficiency and customer data analytics would allow banks to strategically design customer experience journeys with apt offerings by leveraging the expertise of their partners in product development. In a BaaP-like setup, it’ll be unlikely that banks are reduced to an infrastructure provider role. Instead, managing relationships among the many players that make up its ecosystem, a bank would be the only entity to have a holistic view of how all the different moving parts will work together to serve customers efficiently. Now that’s a role that can’t be imitated easily by competition or upstarts.

References

BBVA continues its fintech acquisition run, buys Holvi, an online-only business bank – TechCrunch

HSBC and Tradeshift join forces to revolutionise working capital financing — IBOS

How AWS came to be – TechCrunch

Amazon to ramp up lending in challenge to big banks – Financial Times

FinLeap’s solarisBank to offer Banking-as-a-Platform so startups can ride fintech gravy train – TechCrunch

3 Financial Companies Innovating With Open Source – Linux.com – The source for Linux information — Linux

Fidor: Celent Model Bank of the year 2015 — Celent

Accenture Report on How can Banks Meet Customer Demands — Accenture

Capital One Launches First True Open Banking Platform in US – Programmable Web

BBVA launches its Open Banking business — BBVA|

Smooth Commerce Collaborates with Visa to Improve Mobile Registration Process – Tech Vibes

The Digital Transformation Playbook by David L Rogers – Columbia Business School

Pipelines, Platforms and The New Rules of Strategy – Harvard Business Review

BBVA puts its open APIs into the wild – Business Insider

10 most valuable and powerful brands of the world in 2017 – Gulf News

We are open – Imagining the banking ecosystem of 2025 – Mapa Research

Monzo – It’s time for a new kind of bank – Monzo

Banking-as-a-Service – what you need to know – Ventureskies

Traditional banks and fintech firms: new collaboration models — icar