“Why it’s simply impassible!

Alice: Why, don’t you mean impossible?

Door: No, I do mean impassible. (chuckles) Nothing’s impossible!”― Lewis Carroll, Alice’s Adventures in Wonderland & Through the Looking-Glass

Six of the ten most valuable companies in the world are platform companies. None of the six is a bank. Admittedly, banks are late to the platform party. Nonetheless, banks are set on — what would have been considered impossible until a few years ago — transforming themselves from impassable monoliths to nimbler organisations, open to new kinds of partnerships.

Regulations such as PSD2 and Open Banking that mandate banks open their data vaults to third parties play an important role in this transformation. Banks have started to build public APIs with the aim to create and nurture an ecosystem of external partners (service providers, technology companies and independent developers).

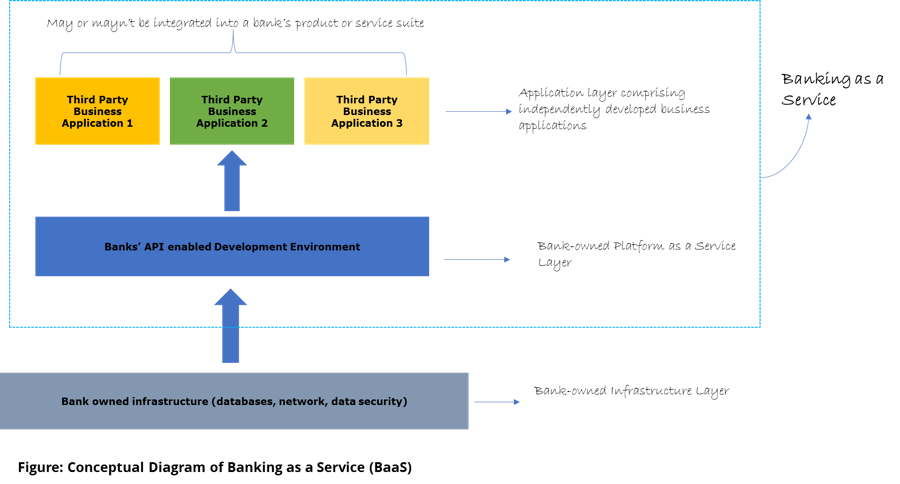

But as we would soon see, Banking-as-a-Service (BaaS) rather than Banking-as-a-Platform (BaaP) more aptly describes banks’ strategy of providing public APIs and development portals. Even though the distinction between BaaS and BaaP is not always clear with the terms often used interchangeably, the two key differences between BaaS and BaaP, according to me are –

- The target end users and

- Extent of integration with banks’ product stacks

In case of BaaS, the target audience is largely confined to third parties and independent developers with a good understanding of using technologies such as APIs to create new solutions. In that sense, the development environment provided by banks act as a Platform-as-a-Service (PaaS) layer to help third parties develop business applications which may or may not be integrated into the banks’ product suites.

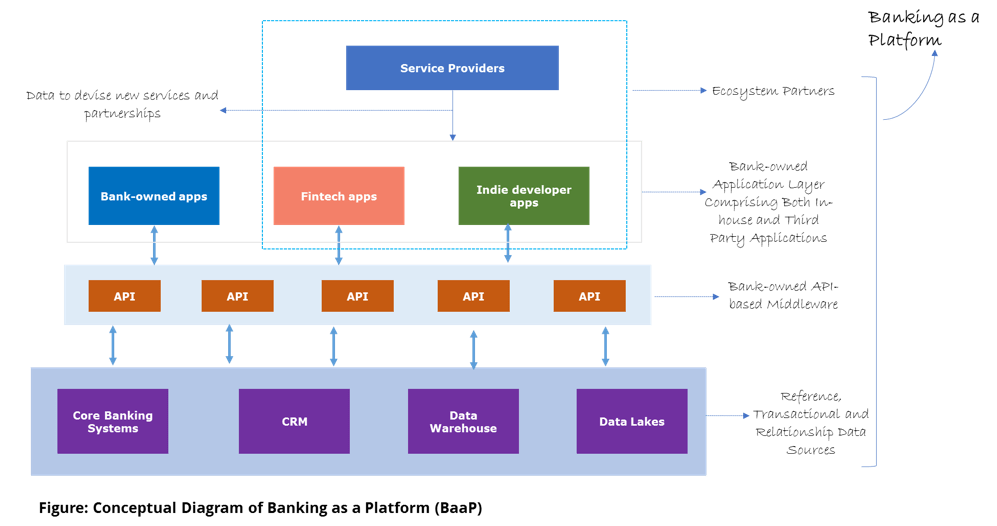

BaaP, on the other hand, is far more comprehensive in that it encompasses banks’ offerings for not just technology partners but also for banking customers. For instance, BBVA’s acquisitions of Simple, a digital-only US bank and Holvi, a Finnish online-only bank for small businesses and entrepreneurs, define BBVA’s attempt to reach customer groups not serviced well by traditional banks. BBVA, through these acquisitions, plans to derive synergies in areas such as customer experience, products and technology that its smaller additions excel in; synergies that’ll be complemented by access to a larger customer base, regulatory compliance and established brand name that the traditional bank possesses.

Nonetheless, for banks, to embark on a BaaS strategy is a precursor to a full-fledged BaaP strategy, in the long run.

Take Monzo, a UK based challenger bank, that clearly states its mission is to build the ‘best current account in the world’. But with a banking license, it can sell many more products and services. In 2016, less than a year after its inception, Monzo started to provide APIs to third parties to build applications that can access Monzo’s customer data. Through APIs, Monzo plans to build a banking marketplace, where its customers will access, in addition to its specialised current account product, banking solutions from different providers — all on Monzo’s platform. Similarly, Starling Bank, early this year, launched its app store along with a developer platform to give access to customer data to external participants to build products and solutions for its customers.

No longer independently blue*

It’s not just the digital banks but even traditional banks that think banking of the future would be modular, where banks would provide only a subset of products and services, while the rest of the offerings would be from an assortment of ecosystem partners. The quest for modularity has also stemmed from constraints beyond regulations.

Not too long ago, mobile first strategy emerged as a dominant theme in banking. Applications were reimagined to be delivered through mobile, adapting to newer, smaller form factors. Mobile-enabled banking on the go – hugely convenient for customers. But the backend infrastructure complexity remained, which meant business challenges, such as lack of personalized products, slower innovation, delayed go-to market persisted? Could APIs be the solution?

APIs, upending industries such as retail, transportation, travel and technology, have gradually gained traction within the financial services industry. Considered an enabler of innovation, APIs are software programs that allow disparate applications to communicate and share information with one another. An API strategy could result in not just enhanced customer experience and competitiveness but also operational efficiency.

Leading banks such as BBVA, Capital One, HSBC, RBS, all have developer portals — offering APIs, software development kits and support to external developers and tech firms to build new solutions. The API based middleware connecting banking assets and third-party applications has led to the rise of Banking-as-a-Service or BaaS.

To understand BaaS, let’s take a simple example – Bank B has a cumbersome paper-based mortgage process. Fintech F has just the solution – a fully digitised product spanning the entire mortgage process from application to approval, complete with a super easy to use interface. F needs customers – a banking license would be good but customers are essential. B’s API gives F access to B’s customer data. Soon, B’s customers have a hassle-free experience applying for mortgages and F has access to a well-established customer base. BaaS can often result in point solutions such as personal finance management tool, accounting software, interest calculators or ATM locators being developed by third parties. These solutions can be sold as standalone applications, be part of an app store, or integrated into a product suite, all of which may or may not be owned by the banks.

In contrast, Banking-as-a-Platform or BaaP is all-encompassing. To understand why we’ll take a quick look at what defines a platform. In part 2 of the series, we’ll also see how companies adopting a platform strategy have transformed not just their business models but also industry models.

*The colour of the logos of most prominent financial brands such as RBS, Barclays, BBVA and Visa is blue