The investment in recent years by large organisations, including the Big Four, has resulted in advanced technology that is changing many aspects of traditional accountancy and tax advisory. They now have technology that can cut the manhours needed on complex audits, do away with the need for sample testing and conduct a more insightful analysis of trends and risks.

The technologies with the biggest impact are artificial intelligence (AI) and blockchain.

Some people argue these technologies eliminate the need for most accounting or tax advisors: AI can perform many finance and accounting functions (and it can learn to perform them better without the need to be programmed), while Blockchain validates any data set continuously – who needs auditors, right?

Reality is not that simple, though it is important for accountants and tax advisors to understand these technologies and what impact they are likely to have.

And that is the first problem – most people in the profession are blissfully ignorant about AI and blockchain (and many other technologies, come to think about it).

Do you know your blockchain?

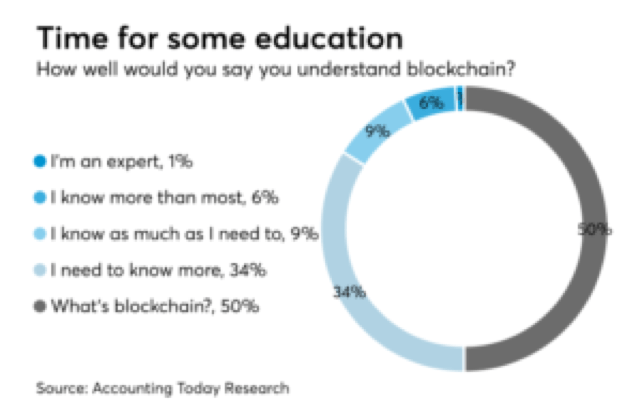

A recent poll by Accounting Today of their readership showed that only 16% of respondents rated themselves as either expert in or even knowing enough about blockchain.

AI seems is more familiar to most accountants, though it still conjures images of Hal in 2001 or maybe the terrifying Skynet of Terminator fame. Luckily, these are not reality (yet?), but they highlight a need for education about what AI already is and what it is likely to be in the future.

So, what is AI?

In simplistic terms, AI is a software that can process large quantities of data, draw conclusions from its processing and execute actions based on that conclusion.

AI can process and analyse huge amounts of data, much more than a human could and it can do so at incredible speed.

So far, so boring: we have been experiencing the power of computer processing for decades.

But what sets AI apart from traditional programming is that AI does not need humans to tell it what to do. There are different ways how AI can “learn” and currently most AI focusses on one subject like a one-trick-pony but the upshot is clear: AI can learn from the data itself and improve without additional programming.

For example, Google has put AI to use in managing power consumptions in its data centres, where constantly changing needs for cooling and adjustments to air temperature, pressure and humidity make for a hugely complex task. Using AI, Google claim has helped them reduce the total energy used by its data centres by 15% without the use of humans.

AI in accounting?

We already know machines are much better at processing large amounts of data. Only, now it impacts on activities that are the domain of highly educated humans.

For example, wouldn’t it be great to have a software that only knows the whole tax code but can make sensible recommendations based on trends? Or review thousands of commercial contracts for anomalies and calculate the risk to the client?

Plus, being able to review an entire population of structured and unstructured data means that AI can do away with the need for sampling in audits.

This is already happening:

Deloitte delights its clients by automating part of their audit process, using AI to test appropriateness journal entries in general ledgers and other adjustments. This has increased throughput by 45%.

EY is applying AI to sifting through lease contracts, expecting 70%-80% of such reviews to be done by AI, while lodging 50% of their bank audit confirmations in Australian audits via AI.

PwC and KPMG are also developing their capabilities with impressive results.

And blockchain – what about that?

The concept of blockchain is less well understood by most people. Partially, because it is a newer idea in technology than AI, and partially because it is harder to turn it into a haunting fictional character a la HAL (2001).

Yet, accountants and tax advisors should be very comfortable with the premise of blockchain. Essentially, the technology is an open-access shared ledger that keeps records of all transactions between parties which cannot be altered. The Institute of Chartered Accountants in England and Wales goes as far as calling blockchain “fundamentally an accounting technology”.

The ledgers are distributed across the internet and users have to agree on their content. “Miners” (distributed computers) verify the ledgers on an on-going basis. New records can only be added if all users agree and past records cannot be altered without the consensus of the majority.

Blockchain is not bitcoin

Blockchain is much more than the cryptocurrency – and it has already some strong use cases. For example, the Sweden Land Registry has been testing blockchain for property purchases and expects to conduct their first blockchain proven transaction shortly.

PwC and EY are already accepting bitcoin as payment methods for some transactions and the Australian Securities Exchange is considering replacing its current clearing and settlement system for share trading with blockchain technology.

What does it mean for the profession?

The impact of these technologies is felt on the ground, with Steve Varley of EY claiming that graduate hiring will fall 50% by 2020.

And Richard Oldfield, head of strategy at PwC UK, states in the Financial Times that “there is no single technological threat to the professional services industry. It’s a tsunami of threats: data analytics, artificial intelligence and cybersecurity”.

Reality is that firms of all sizes will have to make changes. They cannot ignore technology in a marketplace where costs are driven down by technologies that are faster and cheaper than their human counterparts.

Some expect that mainly the bottom part of the professional services pyramid will be impacted. Technology will replace much of the hard work of discovery, analysis and comparison of information which is done at the low-end. Furthermore, low-end services can be replaced by self-service platforms or will become commoditized services, especially when technology enables direct tapping into the flows of client data as needed for instance for accounting and audits.

However, the changes will also work their way up the corporate ladder: with fewer staff overall, there is reduced need for traditional managers.

A need for new skills and behaviours

To capture and deliver value for clients in the future, staff at all levels, including managers (and partners!), will require new skills sets that include a solid basis of understanding in data management and being thoroughly comfortable with new technologies.

Senior managers and partners should no longer delegate understanding and using technology to the “millennials” and young things in their organisations – they need to roll their sleeves up, adopt an open mindset and experiment with new technologies themselves.

Otherwise, they risk looking out of touch in front of their clients when they appear as tech illiterate as (some) US Senators grilling Mark Zuckerberg about data privacy!